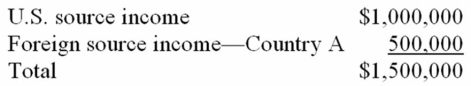

Fleming Corporation, a U.S. multinational, has pretax U.S. source income and foreign source income as follows.  Fleming paid $200,000 income tax to Country A. If Fleming takes the foreign tax credit, compute its worldwide tax burden as a percentage of its pretax income.

Fleming paid $200,000 income tax to Country A. If Fleming takes the foreign tax credit, compute its worldwide tax burden as a percentage of its pretax income.

Definitions:

Cognitive Dissonance

A psychological state where an individual experiences discomfort due to holding conflicting beliefs, attitudes, or behaviors, prompting a change to reduce the dissonance.

Job Descriptive Index

A psychometrically validated survey instrument that measures job satisfaction in five facets: pay, promotion, coworkers, supervision, and the work itself.

Job Satisfaction

The level of contentment employees feel about their jobs, including aspects like work environment, pay, and job duties.

Display Rules

Cultural or organizational guidelines that dictate the appropriate expressions of emotions in various situations.

Q2: Which of the following is a Section

Q4: Mia inherited $1 million from her deceased

Q6: An individual with a 15% rate marginal

Q16: Matthew earned $150,000 in wages during 2012.

Q40: Donatoni Corporation owns 40% of Market, Inc.

Q67: The Schedule M-3 reconciliation requires less detailed

Q69: Sunny, a California corporation, earned the following

Q79: Mrs. Lincoln was employed by GGH Inc.

Q81: Which of the following statements about income

Q84: Slipper Corporation has book income of $500,000.