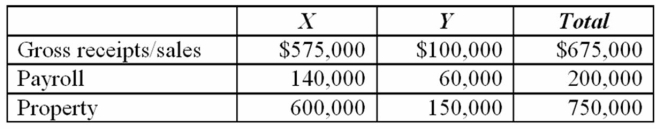

Origami does business in states X and Y. State X uses an equally-weighted three-factor apportionment formula and has a 4 percent state tax rate. State Y uses an apportionment formula that double-weights the sales factor and has a 6 percent tax rate. Cromwell's taxable income, before apportionment, is $3 million. Its sales, payroll, and property information are as follows.  a. Calculate Origami's apportionment factors, income apportioned to each state, and state tax liability.

a. Calculate Origami's apportionment factors, income apportioned to each state, and state tax liability.

b. State Y is considering changing its apportionment formula to a single sales factor. Given its current level of activity, would such a change increase or decrease Origami's state income tax burden? Provide calculations to support your conclusion.

Definitions:

Cash Generated

The total amount of money produced by a company through its operational activities in a specific period.

Comprehensive Income

The total change in equity for a business enterprise during a period from transactions and other events from non-owner sources.

GAAP

Stands for Generally Accepted Accounting Principles, which are a common set of accounting principles, standards, and procedures that companies must follow when they compile their financial statements.

Accrued Taxes

Taxes that have been incurred but not yet paid during a given accounting period, representing a liability on the company's balance sheet.

Q23: Jenna Leigh is employed as a receptionist

Q31: Mr. Rex had his car stolen this

Q32: An inter vivos transfer is a gratuitous

Q33: Individual taxpayers can obtain an automatic extension

Q70: Randolph Scott operates a business as a

Q72: Mr. Lightfoot owns three mortgaged residences that

Q77: Platte River Corporation is a calendar year

Q77: Luce Company exchanged the copyright on a

Q80: According to the realization principle, an increase

Q106: Which of the following statements regarding filing