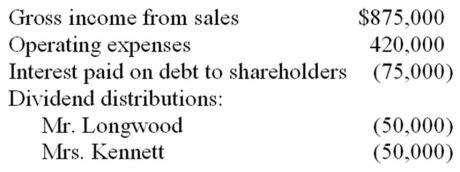

Mr. Longwood and Mrs. Kennett are the equal shareholders in LK Corporation. Both shareholders have a 35 percent marginal tax rate on ordinary income. LK's financial records show the following:  a. Compute the combined tax cost for LK, Mr. Longwood, and Mrs. Kennett attributable to LK's operations.

a. Compute the combined tax cost for LK, Mr. Longwood, and Mrs. Kennett attributable to LK's operations.

b. How would your computation change if the interest on the shareholder debt was $175,000 and LK paid no dividends?

Definitions:

Downsizing

The reduction of an organization's workforce to improve its efficiency and reduce costs, often involving layoffs.

Social Networks

Platforms or communities online where individuals can interact, share information, and build relationships or connections.

External Recruitment

The process of searching for and hiring candidates from outside the organization to fill open positions, expanding the pool of potential talent.

Workforce

The collective group of individuals engaged in or available for work, either in a particular area or in a specific industry.

Q21: For the current tax year, Cuddle Corporation's

Q34: Qualified withdrawals from both traditional and Roth

Q51: The burden of corporate taxation is often

Q51: Which of the following statements regarding the

Q54: Mrs. Starling worked for Abbot Inc. from

Q55: Five years ago, Q&J Inc. transferred land

Q71: Babex Inc. and OMG Company entered into

Q81: Adam and Barbara formed a partnership to

Q89: A firm can use LIFO for computing

Q108: JG Inc. recognized $690,000 ordinary income, $48,000