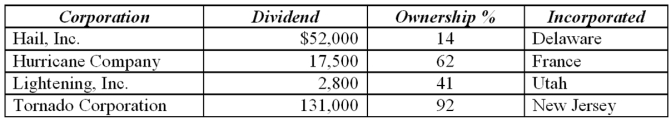

Thunder, Inc. has invested in the stock of several corporations and has $500,000 operating income before dividends.  Calculate Thunder's dividends-received deduction and taxable income:

Calculate Thunder's dividends-received deduction and taxable income:

Definitions:

Actual Overhead Costs

The real expenses that a company incurs for running its operations, excluding direct labor and materials, instead involving costs like utilities and rent.

Budgeted Overhead

An estimate of the total indirect costs expected during a specific period for the efficient operation of a business.

Volume Overhead Variance

The difference between the budgeted and actual fixed manufacturing overhead costs, attributed to changes in production volume.

Manufacturing Overhead

Any expenses related to the production process that are not direct materials or direct labor costs.

Q7: Kent, an unmarried individual, invited his widowed

Q9: Gain realized on a property exchange that

Q30: Wallace Corporation needs an additional worker on

Q34: An individual is indifferent between filing as

Q38: Any individual taxpayer who earns any amount

Q48: Which of the following statements about the

Q51: Mr. and Mrs. Toliver's AGI on their

Q85: Alexus Inc.'s alternative minimum taxable income before

Q95: Szabi Inc., a calendar year taxpayer, purchased

Q102: N&B Inc. sold land worth $385,000. The