Refer to the facts in the preceding problem. Ted is a 20 percent general partner in Bevo.

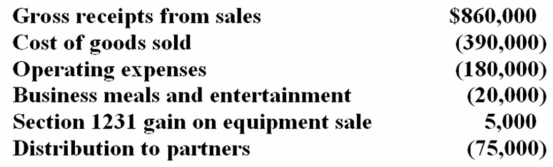

Bevo Partnership had the following financial activity for the year:  a. Compute Ted's share of partnership ordinary income and separately stated items.

a. Compute Ted's share of partnership ordinary income and separately stated items.

b. If Ted's adjusted basis in his Bevo interest was $30,000 at the beginning of the year, compute his adjusted basis at the end of the year. Assume that Bevo's debt did not change during the year.

c. How would your basis computation change if Bevo's debt at the end of the year as $50,000 less than its debt at the beginning of the year?

Definitions:

Expenses

Outflows or other using up of assets or incurrence of liabilities during a period from delivering or producing goods, rendering services, or carrying out other activities that constitute the entity’s ongoing major or central operations.

Held-to-maturity Securities

Financial assets purchased with the intention and ability to hold them until a specified maturity date.

Fair Value

The estimated price at which an asset or liability could be sold or settled in a current transaction between willing parties.

Equity Method

An accounting technique used to record investments in associate companies where the investor has significant influence but not full control, recognizing income in proportion to their share of the earnings.

Q10: Zephex is a calendar year corporation. On

Q22: Hoopin Oil Inc. was allowed to deduct

Q26: Skeen Company paid $90,000 for tangible personalty

Q44: Which of the following entities does not

Q51: A taxpayer that wants to change its

Q66: Monro Inc. uses the accrual method of

Q67: A shareholder in an S corporation includes

Q92: For a corporate taxpayer in the 34%

Q97: Which of the following statements regarding the

Q116: Mr. Stern, a cash basis taxpayer, was