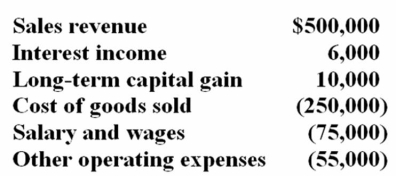

Waters Corporation is an S corporation with two equal shareholders, Mia Jones and David Kerns. This year, Waters recorded the following items of income and expense:  Waters distributed $25,000 to each of its shareholders during the year. If Mia has no other sources of income, what is her gross income for the year?

Waters distributed $25,000 to each of its shareholders during the year. If Mia has no other sources of income, what is her gross income for the year?

Definitions:

Type II Error

The error that occurs when a false null hypothesis is not rejected, also known as a "false negative".

Steroids

Steroids are organic compounds with four rings arranged in a specific molecular configuration, used both in medical treatment and illegally to enhance athletic performance.

Type II Error

The error that occurs when a statistical test fails to reject a false null hypothesis, mistakenly indicating that there is no effect or difference when there is.

Type I Error

The incorrect rejection of a true null hypothesis, also known as a "false positive."

Q3: Hearth, Inc. reported $30,000 of depreciation expense

Q4: During 2012, Scott Howell received a salary

Q8: World Sales, Inc., a U.S. multinational, had

Q19: Which of the following methods of accounting

Q41: Gwen and Travis organized a new business

Q49: Signo Inc.'s current year income statement includes

Q58: Tonto Inc. has used a calendar year

Q62: Mr. Allen, whose marginal tax rate is

Q78: A firm's choice of taxable year is

Q104: Four years ago, Bettis Inc. paid a