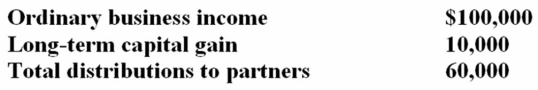

Mutt and Jeff are general partners in M&J Partnership and share profits and losses equally. Partnership operations for the current tax year were:  Mutt's tax basis in his partnership interest at the beginning of the current year was $12,000. What is his basis at the beginning of next year?

Mutt's tax basis in his partnership interest at the beginning of the current year was $12,000. What is his basis at the beginning of next year?

Definitions:

Ground Surface

The top layer of the earth's crust that we walk on and interact with in our everyday lives.

Volcanic Gas

Gases emitted from a volcano, including water vapor, carbon dioxide, sulfur dioxide, hydrogen sulfide, and other volcanic gases.

Convergent

Pertaining to areas where tectonic plates move towards each other, often resulting in mountain building or subduction.

Divergent

Relates to a tectonic boundary where two plates move away from each other, leading to the creation of new crust.

Q4: A U.S. taxpayer can make an annual

Q7: Sissoon Inc. exchanged a business asset for

Q19: Mrs. Paley died on July 14, 2011.

Q26: Which of the following statements concerning the

Q61: Two months ago, Dawes Inc. broke a

Q65: Secondary authorities organize information about primary authorities

Q74: Which of the following statements about like-kind

Q77: Luce Company exchanged the copyright on a

Q82: The use of a corporation as a

Q96: One disadvantage of the creation of a