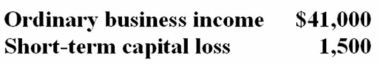

Alex is a partner in a calendar year partnership. His partnership Schedule K-1 for the current tax year showed the following:  Alex has a $7,000 loss carryforward from the partnership last year, which he could not deduct because of the basis limitation. What is his tax basis in his partnership interest at the end of the current tax year?

Alex has a $7,000 loss carryforward from the partnership last year, which he could not deduct because of the basis limitation. What is his tax basis in his partnership interest at the end of the current tax year?

Definitions:

High-SES Families

Households with high socioeconomic status, typically characterized by higher income, education, and occupational status.

Levels of Achievement

Refers to the varying stages or degrees of success and proficiency individuals attain in specific areas or skills.

Mastery Orientation

An approach to learning and achievement that focuses on gaining new skills, improving competence, and understanding material, rather than a focus on outward success.

Fixed Mindsets

The belief that one's abilities, intelligence, and talents are static traits which cannot be significantly developed.

Q3: The United States taxes its citizens on

Q43: Andrews Corporation owns all of the outstanding

Q45: Bisou Inc. made a $48,200 contribution to

Q47: Murrow Corporation generated $285,700 income from the

Q52: Alan is a general partner in ADK

Q56: Borough, Inc. is entitled to a rehabilitation

Q81: Qualifying property received in a nontaxable exchange

Q89: The taxable income earned by a personal

Q98: A foreign source dividend received by a

Q103: Which of the following statements concerning extensions