Refer to the facts in the preceding problem. Ted is a 20 percent general partner in Bevo.

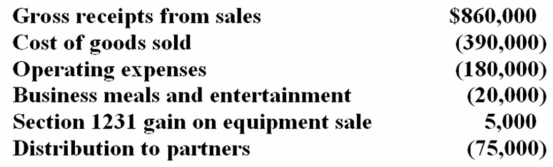

Bevo Partnership had the following financial activity for the year:  a. Compute Ted's share of partnership ordinary income and separately stated items.

a. Compute Ted's share of partnership ordinary income and separately stated items.

b. If Ted's adjusted basis in his Bevo interest was $30,000 at the beginning of the year, compute his adjusted basis at the end of the year. Assume that Bevo's debt did not change during the year.

c. How would your basis computation change if Bevo's debt at the end of the year as $50,000 less than its debt at the beginning of the year?

Definitions:

Complete Package

A product or deal that includes everything needed for a particular purpose or requirement, leaving nothing out.

Reasonable Basis

A standard which requires that claims, especially in law and finance, must have a foundation that is logically sound and justifiable.

Generalities

Statements or ideas that are broad and unspecific, lacking in detailed explanation or specificity.

Exaggerations

Statements that stretch the truth or overstate facts.

Q12: Which of the following statements about organizational

Q20: In order to be claimed as a

Q30: Dividends-received deductions generally are not allowed for

Q35: Mrs. Fuente, who has a 35% marginal

Q37: The Quad affiliated group consists of Quad,

Q40: Last year, Mr. Tyker's AGI was $182,800,

Q50: Which of the following statements regarding exemptions

Q52: Luttrix Inc. does business in Nebraska (6%

Q57: Mrs. Brinkley transferred business property (FMV $340,200;

Q61: Richland Company purchased an asset in 2009