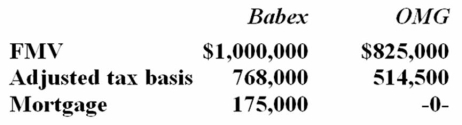

Babex Inc. and OMG Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, OMG assumed the mortgage on the Babex property. Compute Babex's gain recognized on the exchange and its tax basis in the property received from OMG.

Pursuant to the exchange, OMG assumed the mortgage on the Babex property. Compute Babex's gain recognized on the exchange and its tax basis in the property received from OMG.

Definitions:

Assistance

The act of providing help or support, especially to people in need.

Dive Shop

A retail establishment that sells scuba diving and snorkeling equipment, and often offers dive training and dive trip arrangements.

Damages

Monetary compensation awarded by a court to indemnify harm or loss suffered.

Diving Equipment

Tools and gear used for underwater diving adventures, including items like masks, fins, and oxygen tanks.

Q12: Businesses must withhold payroll taxes from payments

Q15: Based on the citation Rev. Rul. 89-157,

Q25: Mann Inc. negotiated a 36-month lease on

Q27: When the Supreme Court denies certiorari, the

Q27: The installment sale method of accounting applies

Q37: Several years ago, Y&S Inc. purchased a

Q65: The foreign tax credit is available for

Q81: A nondeductible charitable contribution is a permanent

Q86: The federal tax law considers the member

Q87: BiState Inc. conducts business in North Carolina