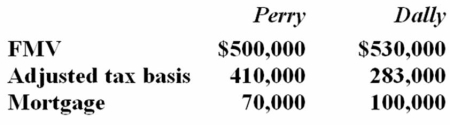

Perry Inc. and Dally Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, Perry assumed the mortgage on the Dally property, and Dally assumed the mortgage on the Perry property. Compute Perry's gain recognized on the exchange and its tax basis in the property received from Dally.

Pursuant to the exchange, Perry assumed the mortgage on the Dally property, and Dally assumed the mortgage on the Perry property. Compute Perry's gain recognized on the exchange and its tax basis in the property received from Dally.

Definitions:

Organizational Representative

An individual who acts as a spokesperson or agent for an organization, embodying its values and objectives in public or professional settings.

Extemporaneous Presentation

A speech or presentation delivered with little preparation, often in a spontaneous or improvised manner.

Manuscript Presentation

The preparation and delivery of academic or literary work for publication or public sharing.

Memorized Presentation

A presentation method where the speaker commits the entire speech to memory, delivering it without the use of notes.

Q8: The assignment of income doctrine holds that:<br>A)

Q22: Hoopin Oil Inc. was allowed to deduct

Q44: The federal income tax deduction allowed for

Q46: If a trial court decision has been

Q57: Mrs. Brinkley transferred business property (FMV $340,200;

Q65: Which of the following statements about the

Q81: Thieves stole computer equipment owned by Eaton

Q92: The gain or loss recognized on any

Q92: NRW Company, a calendar year taxpayer, purchased

Q107: Welch Inc. has used a fiscal ending