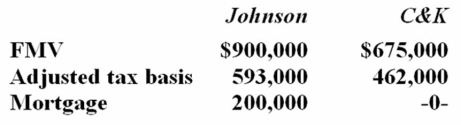

Johnson Inc. and C&K Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property. Compute Johnson's gain recognized on the exchange and its tax basis in the property received from C&K.

Pursuant to the exchange, C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property. Compute Johnson's gain recognized on the exchange and its tax basis in the property received from C&K.

Definitions:

CRISPR-Based Gene Drive

A genetic engineering technology that promotes the inheritance of a particular gene to increase its prevalence in a population, utilizing the CRISPR/Cas9 system to cut and replace DNA segments in a targeted manner.

Plant Virus

Infectious agents that can replicate only inside the living cells of plants, causing various diseases.

Corn Crops

Corn crops, or maize, are cereal grain plants grown for their edible seeds, significant as a staple food resource globally and also used for animal feed, biofuel, and other products.

Comparative Genomics

The study and comparison of genomes from different species to understand genetic similarities, differences, and evolutionary relationships.

Q2: Ms. Dorley's regular tax liability on her

Q17: Which of the following statements about Section

Q24: An accrual basis taxpayer that accrues a

Q31: Vane Company, a calendar year taxpayer, incurred

Q39: The tax basis in property received in

Q48: Which of the following statements about the

Q55: Taxpayers may adopt the cash receipts and

Q59: Southlawn Inc.'s taxable income is computed as

Q65: Cobly Company, a calendar year taxpayer, made

Q79: Frazier, Inc. paid a $150,000 cash dividend