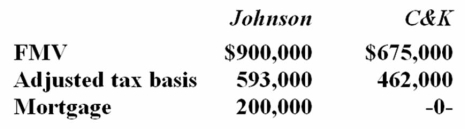

Johnson Inc. and C&K Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property. Compute C&K's gain recognized on the exchange and its tax basis in the property received from Johnson.

Pursuant to the exchange, C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property. Compute C&K's gain recognized on the exchange and its tax basis in the property received from Johnson.

Definitions:

Individual Brands

The use of individual brand names for each of a firm’s products.

Corporate Brands

Identities created for corporations as a whole, incorporating their values, culture, and reputation.

Brand Extension

A marketing strategy in which a firm uses an established brand name to introduce new products or services in a different category.

Line Extension

A marketing strategy where a company introduces additional items in the same product category under the same brand name, such as new flavors, sizes, or other variations.

Q3: The United States taxes its citizens on

Q10: Mr. Bentley exchanged investment land subject to

Q18: The accumulated earnings tax is imposed on

Q23: Which of the following statements concerning the

Q24: Thieves stole computer equipment used by Ms.

Q39: Porter Inc. incurred a $20,000 expense only

Q50: Poole Services, a calendar year taxpayer, billed

Q92: NRW Company, a calendar year taxpayer, purchased

Q96: When unrelated parties agree to an exchange

Q97: G&G Inc. transferred an old asset with