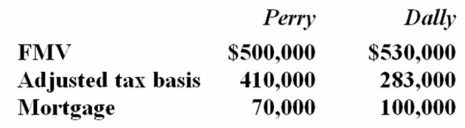

Perry Inc. and Dally Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, Perry assumed the mortgage on the Dally property, and Dally assumed the mortgage on the Perry property. Compute Dally's gain recognized on the exchange and its tax basis in the property received from Perry.

Pursuant to the exchange, Perry assumed the mortgage on the Dally property, and Dally assumed the mortgage on the Perry property. Compute Dally's gain recognized on the exchange and its tax basis in the property received from Perry.

Definitions:

Path Analysis

A statistical technique used in social science to study the direct and indirect relationships between variables in a model.

Dependent Variable

In an experiment or study, the variable being tested and measured, expected to change as a result of variations in the independent variable.

Direction

In the context of statistics, it refers to the nature of the relationship between variables, indicating whether it is positive or negative.

Q5: Using an electronic research database such as

Q6: On December 19, 2012, Acme Inc., an

Q11: Which of the following statements regarding documentation

Q25: Which of the following would not be

Q33: Airfreight Corporation has book income of $370,000.

Q40: Which of the following statements about tax

Q42: If a business is formed as a

Q62: HHF Corporation received permission from the IRS

Q69: When performing step three of the tax

Q72: Merkon Inc. must choose between purchasing a