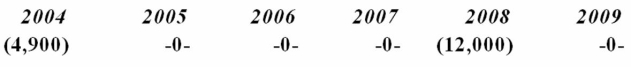

Delour Inc. was incorporated in 2004 and adopted a calendar year. Here is a schedule of Delour's net Section 1231 gains and (losses) reported on its tax returns through 2009.  In 2010, Delour recognized a $50,000 gain on the sale of business land. How is this gain characterized on Delour's tax return?

In 2010, Delour recognized a $50,000 gain on the sale of business land. How is this gain characterized on Delour's tax return?

Definitions:

Loyalty

A strong feeling of support or allegiance to someone or something, often manifesting as dedication or faithfulness.

Sportsmanship

The practice of playing fair, following the rules of the game, and showing respect for opponents, teammates, and officials.

Cross-Cultural Teams

Teams made up of members from different cultural backgrounds working together towards a common goal.

Virtual Teams

Groups that interact primarily through electronic means, with little, if any, in-person contact.

Q25: Mr. Jamail transferred business personalty (FMV $187,000;

Q29: Four years ago, Bettis Inc. paid a

Q48: Tax law uncertainty is the risk that

Q56: Arm's length business transactions can occur in:<br>A)

Q62: When unrelated parties agree to an exchange

Q66: If a new business organized as a

Q67: The principle of conservatism reflected by GAAP

Q73: Tax judicial decisions each have a single,

Q83: Assuming a 30% marginal tax rate, compute

Q105: Terrance Inc., a calendar year taxpayer, purchased