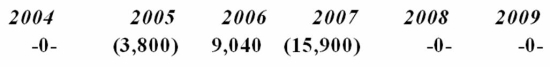

Proctor Inc. was incorporated in 2004 and adopted a calendar year. Here is a schedule of Proctor's net Section 1231 gains and (losses) reported on its tax returns through 2009.  In 2010, Proctor recognized a $25,000 gain on the sale of business land. How is this gain characterized on Proctor's tax return?

In 2010, Proctor recognized a $25,000 gain on the sale of business land. How is this gain characterized on Proctor's tax return?

Definitions:

Assembly Activity Cost Pool

A grouping of all costs related to the assembly process in activity-based costing, used to allocate costs to products or services.

Labor-Hour

A measure of work accomplished, recorded, or billed based on the number of hours worked.

Activity-Based Costing

A method of allocating overhead and indirect costs to products or services based on the activities that drive those costs.

Cost Of Serving

The total expenses incurred while delivering a service or product to a customer.

Q32: Treasury regulations are considered statutory authority.

Q38: Bart owns 100% of an S corporation

Q50: Poole Services, a calendar year taxpayer, billed

Q53: The three Crosby children intend to form

Q60: A corporate shareholder usually cannot be held

Q69: An affiliated group consists of a parent

Q81: Qualifying property received in a nontaxable exchange

Q83: Kigin Company spent $240,000 to clean up

Q89: Which of the following statements concerning the

Q92: NRW Company, a calendar year taxpayer, purchased