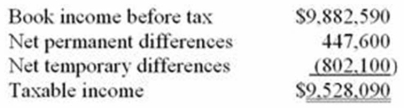

B&B Inc.'s taxable income is computed as follows.  Using a 34% rate, compute B&B's tax expense per books and tax payable.

Using a 34% rate, compute B&B's tax expense per books and tax payable.

Definitions:

Par Value

The nominal value of a bond or stock as declared by the issuer, which might not match its value on the market.

Annual Dividend

The annual dividend is the total amount of dividend payments a company distributes to its shareholders over a year.

Common Stock

A type of security representing ownership in a corporation, entitling the holder to vote at shareholders' meetings and receive dividends.

Constant Rate

A fixed percentage that does not change over the specified period of time.

Q10: Planning opportunities are created when the tax

Q22: The abandonment of business equipment with a

Q23: In an inflationary economy, the use of

Q28: PPQ Inc. wants to change from a

Q42: An increase in the risk associated with

Q56: Which of the following businesses can't use

Q62: When unrelated parties agree to an exchange

Q67: Mr. Vail made an offer to purchase

Q85: Alexus Inc.'s alternative minimum taxable income before

Q105: Which of the following statements about short-period