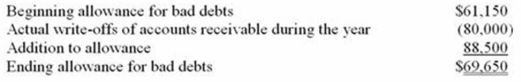

Monro Inc. uses the accrual method of accounting. Here is a reconciliation of Monro's allowance for bad debts for the current year.  Because of the difference between the GAAP and the tax rules for accounting for bad debts, Monro Inc. has an:

Because of the difference between the GAAP and the tax rules for accounting for bad debts, Monro Inc. has an:

Definitions:

Course Of Action

A plan or strategy intended to accomplish a specific goal.

Investment

Investment involves allocating resources, usually money, with the expectation of generating an income or profit.

Obedience

A form of social influence where an individual acts in response to a direct order from another individual, who is usually an authority figure.

Hideous Crimes

Acts that are particularly shocking due to their gruesome, violent, or morally reprehensible nature.

Q1: Nagin Inc. transferred an old asset in

Q6: Gregly Company, which has a 33% marginal

Q10: Stanley Inc., a calendar year taxpayer, purchased

Q14: Kornek Inc. transferred an old asset with

Q52: Huml Inc. could not deduct an accrued

Q65: Deduction-shifting transactions usually occur between unrelated taxpayers.

Q69: Which of the following statements about marginal

Q76: The country of Valhalla levies an income

Q88: Which of the following statements about the

Q91: Which of the following business expenses always