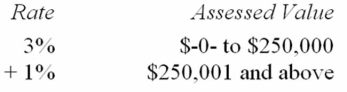

Vervet County levies a real property tax based on the following schedule.  Which of the following statements is false?

Which of the following statements is false?

Definitions:

CAPM

The Capital Asset Pricing Model, a theory that describes the relationship between systematic risk and expected return for assets, particularly stocks.

Regression Equation

An equation used in statistics to describe the relationship between a dependent variable and one or more independent variables.

CAPM

The Capital Asset Pricing Model, a theory that describes the relationship between the expected return and risk of investing in a security.

Risk-Free Rate

The theoretical rate of return of an investment with zero risk, typically represented by the yield on government securities like U.S. Treasury bonds.

Q3: The MACRS calculation is based on the

Q7: JKL Inc. and Matthew Inc. enter into

Q21: Mr. and Mrs. Churchill operate a small

Q21: Huml Inc. could not deduct an accrued

Q33: OWB Inc. and Owin Inc. are owned

Q41: Maxcom Inc. purchased 15 passenger automobiles for

Q48: Which of the following statements most accurately

Q67: Ms. Ellis sold 889 shares of publicly

Q72: Experienced tax professionals generally can answer most

Q103: Molton Inc., which operates a chain of