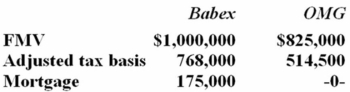

Babex Inc. and OMG Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, OMG assumed the mortgage on the Babex property. Compute Babex's gain recognized on the exchange and its tax basis in the property received from OMG.

Pursuant to the exchange, OMG assumed the mortgage on the Babex property. Compute Babex's gain recognized on the exchange and its tax basis in the property received from OMG.

Definitions:

Progesterone

A steroid hormone secreted by the corpus luteum of the ovary and by the placenta, which acts to prepare the uterus for implantation of the fertilized egg.

Secreted by Ovary

Refers to substances, such as hormones (e.g., estrogen and progesterone), that are released or produced by the ovaries.

After Ovulation

The phase after ovulation, known as the luteal phase, involves the secretion of progesterone to prepare the uterus for potential pregnancy.

LH

Luteinizing hormone, a hormone produced by the anterior pituitary gland that triggers ovulation in females and stimulates testosterone production in males.

Q2: Nolan Inc. sold marketable securities with a

Q3: Which of the following statements regarding secondary

Q47: A taxpayer should prefer to pay a

Q50: Warsham Inc. sold land with a $300,000

Q51: Which of the following statements about amortization

Q52: The business purpose doctrine allows the IRS

Q63: LiO Company transferred an old asset with

Q67: Which of the following does not characterize

Q90: The tax character of an item of

Q90: Mr. Jason realized a gain on sale