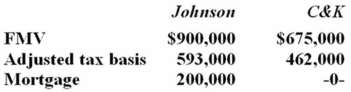

Johnson Inc. and C&K Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property. Compute Johnson's gain recognized on the exchange and its tax basis in the property received from C&K.

Pursuant to the exchange, C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property. Compute Johnson's gain recognized on the exchange and its tax basis in the property received from C&K.

Definitions:

Somatic Delusion

A false belief concerning the body, such as thinking one has a serious disease or body part dysfunction when it is not true.

Spider Eggs

Refers to the eggs produced by spiders, encapsulated in silk egg sacs for protection and development.

Fingernails

Keratin-based structures at the tips of the fingers, protecting the fingertip and surrounding tissue, and serving various biological and aesthetic functions.

Hopelessness Theory

A cognitive theory suggesting that a pessimistic outlook on life, where one feels a lack of control over outcomes, can lead to depression.

Q7: Step five of the tax research process:<br>A)Is

Q21: Tax research may occur as part of

Q25: Durna Inc., a calendar year taxpayer, made

Q45: Mr. Ohno owns and operates a part-time

Q46: A casualty loss realized on the destruction

Q47: Locate the revenue procedure that includes the

Q59: Which of the following is not a

Q82: Repair costs incurred to keep a tangible

Q82: On May 13, 2011, a flood destroyed

Q114: Lawes Company, a cash basis business, mailed