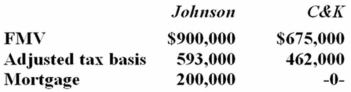

Johnson Inc. and C&K Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property. Compute C&K's gain recognized on the exchange and its tax basis in the property received from Johnson.

Pursuant to the exchange, C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property. Compute C&K's gain recognized on the exchange and its tax basis in the property received from Johnson.

Definitions:

Corrective Action

A process or an action taken to fix a detected problem or deviation from a set standard in an organization.

Uncertain Future

pertains to the unpredictability of events, developments, or outcomes in times ahead.

Performance Pressures

The demands or stress placed on individuals or organizations to achieve high levels of output or success.

Analyzing Alternatives

The process of evaluating different options or approaches to identify the most effective solution to a problem or decision.

Q1: Which of the following statements regarding a

Q6: A taxpayer who receives or pays boot

Q7: Loonis Inc. and Rhea Company formed LooNR

Q15: Which of the following statements about different

Q21: Which of the following statements about the

Q45: Mr. Ohno owns and operates a part-time

Q58: Which of the following is an earmarked

Q71: Acme Inc. is planning a transaction that

Q75: Ms. Kent has $200,000 in an investment

Q90: The substance over form doctrine allows the