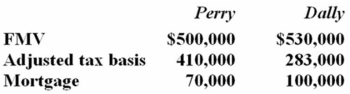

Perry Inc. and Dally Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, Perry assumed the mortgage on the Dally property, and Dally assumed the mortgage on the Perry property. Compute Perry's gain recognized on the exchange and its tax basis in the property received from Dally.

Pursuant to the exchange, Perry assumed the mortgage on the Dally property, and Dally assumed the mortgage on the Perry property. Compute Perry's gain recognized on the exchange and its tax basis in the property received from Dally.

Definitions:

Noninterest-Bearing Note

A promissory note that does not accrue interest over its lifetime, meaning the borrower repays only the principal amount.

Current Interest Rates

Current interest rates are the rates at which interest is paid by borrowers for the use of money that they borrow from lenders.

Notes Receivable Dishonored

A note that was not paid by the maker at its due date, considered a defaulted payment.

Protest Fee

A fee charged for formally declaring a party's disagreement or refusal to accept a financial obligation or document, often relating to banking instruments like checks.

Q12: Which of the following primary authorities is

Q13: Tauber Inc. and J&I Company exchanged like-kind

Q24: What is the first step in the

Q30: Treasury regulations are tax laws written by

Q34: Acme Inc.'s property taxes increased by $65,000

Q40: Which of the following statements about tax

Q47: A corporation can use the installment sale

Q84: Which of the following is/are not a

Q85: Payment of a tax entitles the payer

Q109: Eddy Corporation engaged in a transaction that