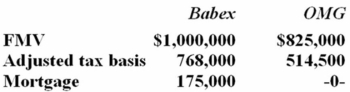

Babex Inc. and OMG Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, OMG assumed the mortgage on the Babex property. Compute Babex's gain recognized on the exchange and its tax basis in the property received from OMG.

Pursuant to the exchange, OMG assumed the mortgage on the Babex property. Compute Babex's gain recognized on the exchange and its tax basis in the property received from OMG.

Definitions:

Wyoming

A state in the western United States known for its wide-open spaces, mountains, and natural beauty, as well as being the least populous state.

Members

Individuals who are part of a group, organization, or body with specific roles, rights, or duties.

S Corporations

A type of corporation in the United States that meets specific Internal Revenue Code requirements and passes income, losses, deductions, and credits through to shareholders for federal tax purposes.

Shareholders

Individuals or entities that own shares in a corporation, giving them certain rights and potential for financial returns based on the company's performance.

Q13: Lensa Inc. purchased machinery several years ago

Q14: Bendom Inc, a calendar year, accrual basis

Q27: Which of the following statements about the

Q28: Revenue rulings are an example of administrative

Q40: Which of the following statements about tax

Q51: Which of the following entities is not

Q59: Which of the following statements about ordinary

Q72: The assignment of income doctrine constraints tax

Q78: Earl Company uses the accrual method of

Q90: Three individuals transferred property to newly formed