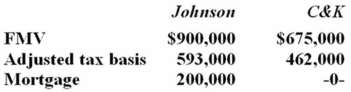

Johnson Inc. and C&K Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property. Compute Johnson's gain recognized on the exchange and its tax basis in the property received from C&K.

Pursuant to the exchange, C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property. Compute Johnson's gain recognized on the exchange and its tax basis in the property received from C&K.

Definitions:

Cost Accounting Systems

Systems used by businesses to track, record, and analyze costs associated with their operations to aid in budgeting, cost control, and profitability analysis.

Job Order Costing

An accounting method used to track the costs associated with producing a specific item or completing a specific job.

Process Costing

A rephrased definition: An accounting methodology employed to evaluate the cost of producing products that undergo similar processes in large quantities.

Underapplied Overhead

A situation where the allocated or applied factory overhead costs are less than the actual overhead costs incurred, resulting in a cost variance.

Q4: Revenue procedures are a type of secondary

Q10: Which of the following statements does not

Q17: Marchal Inc., a calendar year, accrual basis

Q57: When unrelated parties agree to an exchange

Q60: The 15% preferential tax rate on capital

Q61: A dynamic forecast of the incremental revenue

Q61: Cosmo Inc. paid $15,000 plus $825 sales

Q63: Which of the following is not an

Q76: The city of Mayfield charges individuals convicted

Q84: Puloso Company, a calendar year taxpayer, incurred