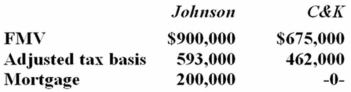

Johnson Inc. and C&K Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property. Compute C&K's gain recognized on the exchange and its tax basis in the property received from Johnson.

Pursuant to the exchange, C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property. Compute C&K's gain recognized on the exchange and its tax basis in the property received from Johnson.

Definitions:

GDP

Gross Domestic Product, the total market value of all final goods and services produced within a country in a given period.

Public Infrastructure

The foundational facilities and systems serving a country, city, or area, including the services and facilities necessary for its economy to function, such as transportation, communication, sewage, water, and electric systems.

Public Debt

The total amount of money that a government has borrowed and not yet repaid, including both internal and external borrowings.

GDP

A rephrased definition: The sum value of all goods and services produced over a specific time frame within a nation's borders.

Q4: Tregor Inc., which manufactures plastic components, rents

Q16: Ad valorem property taxes are the major

Q24: The federal Social Security tax burden on

Q26: Novice tax researchers tend to exam less

Q33: OWB Inc. and Owin Inc. are owned

Q37: Congress plans to amend the federal income

Q40: Which of the following statements about tax

Q41: Maxcom Inc. purchased 15 passenger automobiles for

Q55: Tatun Inc. pays state income tax at

Q66: Both corporate and individual taxpayers can deduct