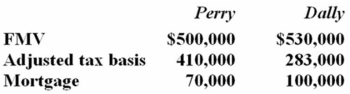

Perry Inc. and Dally Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, Perry assumed the mortgage on the Dally property, and Dally assumed the mortgage on the Perry property. Compute Perry's gain recognized on the exchange and its tax basis in the property received from Dally.

Pursuant to the exchange, Perry assumed the mortgage on the Dally property, and Dally assumed the mortgage on the Perry property. Compute Perry's gain recognized on the exchange and its tax basis in the property received from Dally.

Definitions:

Units

Measurements or quantities of a product, item, or component, often used as a basis for production, inventory, or sales.

Waiting-Line Problem

A scenario in operational research where the focus is on reducing waiting times and improving service efficiency in queueing systems.

Operations

Activities involved in the day-to-day running of a business for producing and delivering products or services.

Average Time

The mean time taken to complete a task or process, calculated by summing all the recorded times and dividing by the number of observations.

Q5: A sales tax is an example of

Q10: Selkie Inc. paid a $2 million lump

Q25: Mr. and Mrs. Marley operate a small

Q30: Moses Inc. purchased office furniture for $8,200

Q40: If a taxpayer decides to take advantage

Q51: A tax on net income is an

Q55: A taxpayer who transfers property for corporate

Q58: Which of the following is an earmarked

Q60: Which of the following statements about the

Q97: Princetown Inc. has a $4.82 million basis