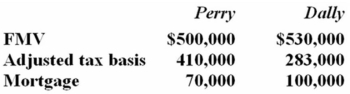

Perry Inc. and Dally Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, Perry assumed the mortgage on the Dally property, and Dally assumed the mortgage on the Perry property. Compute Dally's gain recognized on the exchange and its tax basis in the property received from Perry.

Pursuant to the exchange, Perry assumed the mortgage on the Dally property, and Dally assumed the mortgage on the Perry property. Compute Dally's gain recognized on the exchange and its tax basis in the property received from Perry.

Definitions:

Neuroendocrine Signaling

Neuroendocrine cells produce neurohormones that are transported down axons and released into the interstitial fluid.

cAMP

Cyclic Adenosine Monophosphate, known as a secondary messenger, plays a crucial role in numerous biological functions, particularly in controlling metabolism.

Parathyroid Hormone

A hormone secreted by the parathyroid glands that regulates calcium levels in a person's body.

Blood Calcium Levels

The concentration of calcium in the blood, crucial for various physiological processes including bone formation and muscle contraction.

Q2: Mr. Dole needed to sell appreciated stock

Q14: Both corporate and individual taxpayers can carry

Q21: Mrs. Volter exchanged residential real estate for

Q25: Private market transactions create an opportunity for

Q25: A corporation's tax basis in property received

Q27: Use the present value tables included in

Q30: Treasury regulations are tax laws written by

Q38: Ingol Inc. was organized on June 1

Q54: The goal of tax planning is to

Q83: For its first taxable year, UY Products