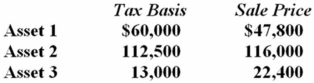

Gupta Company made the following sales of capital assets this year.  What is the effect of the three sales on Gupta's taxable income?

What is the effect of the three sales on Gupta's taxable income?

Definitions:

Hox Genes

Hox genes are a group of related genes that control the body plan of an embryo along the head-tail axis by specifying regions of development in early embryonic segments.

Animal Evolution

The gradual development of diverse species of animals over geological time from common ancestors through changes in traits and genetics.

Blastopore

The initial opening that develops during early embryonic development in animals, leading to the formation of the digestive tract.

Deuterostomes

A grouping of animals characterized by their embryonic development; during the formation of the mouth and anus, the anus forms before the mouth.

Q10: Corporations, LLCs, and partnerships are all taxable

Q26: Lorch Company exchanged an old asset with

Q36: Milton Inc. recognized a $1,300 net Section

Q40: Mrs. Biggs invested in a business that

Q45: Private letter rulings and technical advice memoranda

Q46: Poole Services, a calendar year taxpayer, billed

Q47: Mr. Smith resides in a state with

Q90: Three individuals transferred property to newly formed

Q94: W&F Company, a calendar year taxpayer, purchased

Q109: Eddy Corporation engaged in a transaction that