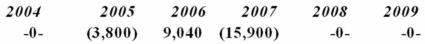

Proctor Inc. was incorporated in 2004 and adopted a calendar year. Here is a schedule of Proctor's net Section 1231 gains and (losses) reported on its tax returns through 2009.  In 2010, Proctor recognized a $25,000 gain on the sale of business land. How is this gain characterized on Proctor's tax return?

In 2010, Proctor recognized a $25,000 gain on the sale of business land. How is this gain characterized on Proctor's tax return?

Definitions:

Cultural Values

The core principles and ideals upon which an entire community exists, influencing behaviors, beliefs, and norms within a society.

Incidence Rate

A measure used in epidemiology to describe the frequency of new cases of a disease or condition in a population over a specific period of time.

Bipolar Disorders

A group of mood disorders characterized by dramatic shifts in a person's mood, energy, and ability to function, typically between manic and depressive states.

Bipolar Disorder

A psychiatric disorder characterized by extreme mood swings from manic highs to depressive lows.

Q5: Which of the following statements about the

Q17: Changes in the tax law intended to

Q18: Leto Inc. has $500,000 in an investment

Q25: Private market transactions create an opportunity for

Q28: The federal government imposed the first income

Q30: Mr. Trail engaged in a current-year transaction

Q38: Which of the following statements about discount

Q68: Hubern Inc. is planning a transaction that

Q81: Which of the following statements concerning the

Q88: Yelano Inc. exchanged an old forklift used