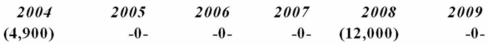

Delour Inc. was incorporated in 2004 and adopted a calendar year. Here is a schedule of Delour's net Section 1231 gains and (losses) reported on its tax returns through 2009.  In 2010, Delour recognized a $50,000 gain on the sale of business land. How is this gain characterized on Delour's tax return?

In 2010, Delour recognized a $50,000 gain on the sale of business land. How is this gain characterized on Delour's tax return?

Definitions:

Ethical Dilemma

A situation where one faces a decision between two morally correct actions that conflict in some way.

Switching Members

The act of replacing or rotating members within a team or group, often to bring new perspectives or skills.

Decision-Making Model

A conceptual framework that describes the sequence of steps taken to make decisions, often including problem identification, information gathering, alternative evaluation, and selection.

Human Logic

The process of reasoning and thinking that is characteristic of the human mind, including the ability to draw inferences and make conclusions based on information.

Q16: Understal Company has $750,000 to invest and

Q33: Which of the following statements about the

Q37: The tax law applies uniformly to every

Q47: A taxpayer should prefer to pay a

Q50: In June, a fire completely destroyed office

Q50: Ms. Kent has $200,000 in an investment

Q58: The tax cost of a transaction represents

Q63: The arm's length transaction presumption is unreliable

Q65: Mrs. Scott received a $12,000 cash payment.

Q67: Which of the following does not characterize