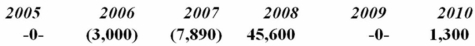

Irby Inc. was incorporated in 2005 and adopted a calendar year. Here is a schedule of Irby's net Section 1231 gains and (losses) reported on its tax returns through 2010.  In 2011, Irby recognized a $14,750 gain on the sale of business land. How is this gain characterized on Irby's tax return?

In 2011, Irby recognized a $14,750 gain on the sale of business land. How is this gain characterized on Irby's tax return?

Definitions:

Emotional Status

The current state of a person's emotional well-being, which can affect behavior, thought processes, and overall mental health.

Geriatric Depression Scale

A screening tool designed to assess depression in older adults.

Moderate Pain

A level of pain that is noticeable and distracting but can still be managed with over-the-counter medication or non-pharmacological methods.

Skilled Nursing Facility

A healthcare facility offering long-term nursing care, rehabilitation services, and medical supervision.

Q6: Mrs. Day structures a transaction to convert

Q25: Which of the following statements about a

Q27: A keyword search using an electronic database

Q29: Rydel Inc. was incorporated on August 9

Q47: Hubern Inc. is planning a transaction that

Q52: When performing step one of the tax

Q53: Which of the following statements about the

Q64: Mallow Inc., which has a 35% tax

Q79: Sancel Inc. is planning a transaction that

Q87: Marz Services Inc. is a personal service