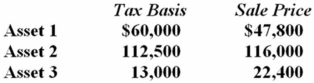

Gupta Company made the following sales of capital assets this year.  What is the effect of the three sales on Gupta's taxable income?

What is the effect of the three sales on Gupta's taxable income?

Definitions:

Office Supplies

Items used in offices by businesses and other organizations, typically including small expendable items such as pens, paper, staples, and envelopes.

Closing Process

The accounting procedure used to close out temporary accounts and transfer their balances to permanent accounts at the end of an accounting period.

Net Income

The amount of money remaining after all operating expenses, taxes, interest, and dividends are deducted from total revenue; a key indicator of company profitability.

Retained Earnings

The portion of a company's profits that is held or retained and not paid out as dividends to shareholders, often used for reinvestment in the business.

Q30: Two years ago, Ipenex Inc., an accrual

Q35: Unlow Inc. must choose between two alternate

Q43: The tax law provides that individuals do

Q59: Merkon Inc. must choose between purchasing a

Q61: Cosmo Inc. paid $15,000 plus $825 sales

Q65: Mrs. James plans to invest in one

Q71: Mr. and Mrs. Sykes operate a very

Q77: For tax purposes, every asset is a

Q91: The tax character of an item of

Q108: Winslow Company sold investment land to an