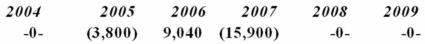

Proctor Inc. was incorporated in 2004 and adopted a calendar year. Here is a schedule of Proctor's net Section 1231 gains and (losses) reported on its tax returns through 2009.  In 2010, Proctor recognized a $25,000 gain on the sale of business land. How is this gain characterized on Proctor's tax return?

In 2010, Proctor recognized a $25,000 gain on the sale of business land. How is this gain characterized on Proctor's tax return?

Definitions:

Demand

The amount of a product or service buyers are prepared and capable of buying at a specific price.

Tax

A mandatory monetary fee or different kind of tax enforced on a taxpayer by a government entity.

Supply

The aggregate supply of a distinct item or service offered to purchasers.

Cloth

A material made from fibers, woven or knitted together, used to make garments and other items.

Q10: Which of the following does not result

Q20: Goff Inc.'s taxable income is computed as

Q24: Mrs. Jax plans to pay $100,000 for

Q34: Both the individual and the corporate federal

Q51: Jelk Company is structuring a transaction that

Q68: Environmental clean-up costs are generally deductible in

Q69: Planning opportunities are created when the tax

Q70: Firms engaged in the extraction of natural

Q70: Mr. Fox has $200,000 to invest. He

Q97: Dorian, a calendar year corporation, purchased $1,568,000