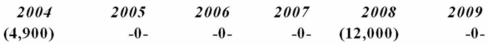

Delour Inc. was incorporated in 2004 and adopted a calendar year. Here is a schedule of Delour's net Section 1231 gains and (losses) reported on its tax returns through 2009.  In 2010, Delour recognized a $50,000 gain on the sale of business land. How is this gain characterized on Delour's tax return?

In 2010, Delour recognized a $50,000 gain on the sale of business land. How is this gain characterized on Delour's tax return?

Definitions:

Journal Entry

A record in accounting that logs a transaction and shows the affected accounts in the form of debits and credits.

Debits

Accounting entries that increase assets or expenses and decrease liabilities, equity, or revenue, recorded on the left side of accounting ledgers.

Credits

Accounting entries that increase liabilities or decrease assets, or record income in double-entry bookkeeping.

Q2: Mr. Dole needed to sell appreciated stock

Q19: Mr. Stern, a cash basis taxpayer, was

Q25: Private market transactions create an opportunity for

Q36: Sellers of retail goods are responsible for

Q39: Jurisdiction M imposes an individual income tax

Q53: Which of the following statements about the

Q54: V&P Company exchanged unencumbered investment land for

Q65: A static forecast of the incremental revenue

Q67: The state of California plans to amend

Q94: Which of the following statements describes a