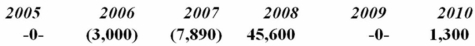

Irby Inc. was incorporated in 2005 and adopted a calendar year. Here is a schedule of Irby's net Section 1231 gains and (losses) reported on its tax returns through 2010.  In 2011, Irby recognized a $14,750 gain on the sale of business land. How is this gain characterized on Irby's tax return?

In 2011, Irby recognized a $14,750 gain on the sale of business land. How is this gain characterized on Irby's tax return?

Definitions:

Visual

Relating to seeing or sight, involving the use of vision.

Auditory

Relating to the sense of hearing or the system and structures involved in hearing.

Heuristic

A problem-solving approach using practical methods or various shortcuts to produce solutions that may not be perfect but are sufficient for the immediate goals.

Optimal Solution

The best possible outcome or answer to a problem, often found through specific methods or algorithms in mathematics, computer science, or operations research.

Q2: Mr. Dole needed to sell appreciated stock

Q16: Use the present value tables included in

Q25: Which of the following statements about a

Q30: Zeron Inc. generated $1,349,600 ordinary income from

Q38: Which of the following statements about discount

Q38: Blitza Inc. owned real property used for

Q55: NWR Inc. is structuring a transaction that

Q66: Jurisdiction M imposes an individual income tax

Q75: Which of the following statements concerning tax

Q85: Unex Company is an accrual basis taxpayer.