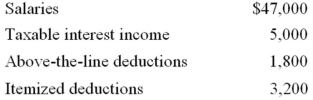

Mr. and Mrs. Liddy, ages 39 and 41, file a joint return and have no dependents for the year. Here is their relevant information.  Compute their adjusted gross income (AGI) and taxable income.

Compute their adjusted gross income (AGI) and taxable income.

Definitions:

Perpetuity

A financial instrument that pays a fixed amount of money indefinitely, with no end date.

Annually Compounded

A method of calculating interest where the interest is added to the principal sum once a year, resulting in interest on interest.

Fair Market Value

The price at which an asset would trade in a competitive auction setting, reflecting the true value as agreed upon by a willing buyer and seller.

RRSP

A Registered Retirement Savings Plan, a Canadian investment account for holding savings and investment assets, with certain tax advantages.

Q3: A professional tax return preparer must attach

Q6: Bryan Houlberg expects his C corporation to

Q6: Congress provides an indirect subsidy to charities

Q9: A person can't be relieved of liability

Q11: Which of the following is excluded from

Q12: Harmon, Inc. was incorporated and began business

Q14: Randolph Scott operates a business as a

Q19: Any gain recognized on the sale of

Q39: Mr. and Mrs. Upton's marginal tax rate

Q64: Ms. Poppe, a single taxpayer, made three