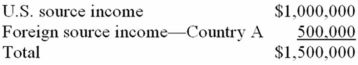

Fleming Corporation, a U.S. multinational, has pretax U.S. source income and foreign source income as follows.  Fleming paid $200,000 income tax to CountryA. If Fleming takes the foreign tax credit, compute its worldwide tax burden as a percentage of its pretax income.

Fleming paid $200,000 income tax to CountryA. If Fleming takes the foreign tax credit, compute its worldwide tax burden as a percentage of its pretax income.

Definitions:

New Task

A previously unencountered or novel assignment or activity that requires completion.

Confidence

A feeling of self-assurance arising from an appreciation of one's own abilities or qualities.

Fundamental Attribution Error

The tendency to overestimate the impact of personal traits and underestimate the influence of situations when explaining others' behaviors.

Scheduled Work Break

A specified interval during work designated for rest or leisure.

Q3: On April 19 of this year, Sandy

Q17: Which of the following statements concerning judicial

Q25: The sales factor in the UDITPA state

Q30: Mr. and Mrs. Lester failed to report

Q38: Which of the following items is included

Q57: Which of the following would not be

Q63: The unextended due date for the individual

Q72: Lindsey owns and actively manages an apartment

Q99: Self-employed individuals are allowed to deduct the

Q107: Which of the following statements concerning the