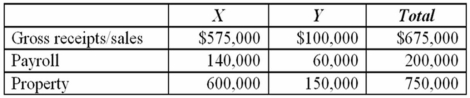

Origami does business in states X and Y. State X uses an equally-weighted three-factor apportionment formula and has a 4 percent state tax rate. State Y uses an apportionment formula that double-weights the sales factor and has a 6 percent tax rate. Cromwell's taxable income, before apportionment, is $3 million. Its sales, payroll, and property information are as follows.  a. Calculate Origami's apportionment factors, income apportioned to each state, and state tax liability.

a. Calculate Origami's apportionment factors, income apportioned to each state, and state tax liability.

b. State Y is considering changing its apportionment formula to a single sales factor. Given its current level of activity, would such a change increase or decrease Origami's state income tax burden? Provide calculations to support your conclusion.

Definitions:

Subscription Service

A business model where customers pay a recurring price at regular intervals for access to a product or service.

Survey

A research method used to collect data from a predefined group of respondents to gain information and insights on various topics of interest.

Average Age

The sum of the ages of all individuals in a group divided by the number of individuals, used to represent the midpoint of age in the group.

Random

Lacking pattern or predictability in events, often used to describe a method for selecting samples in research to avoid bias.

Q6: Ms. Plant owns and actively manages an

Q9: In 1996, Mr. Exton, a single taxpayer,

Q18: Tri-State's, Inc. operates in Arkansas, Oklahoma, and

Q19: If a business is formed as an

Q26: Bess gave her grandson ten acres of

Q38: Which of the following statements concerning qualified

Q51: At the beginning of year 1, Paulina

Q64: Ms. Poppe, a single taxpayer, made three

Q70: A user fee entitles the payer to

Q84: This year, Plateau, Inc.'s before-tax income was