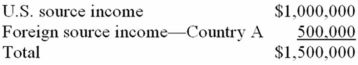

Fleming Corporation, a U.S. multinational, has pretax U.S. source income and foreign source income as follows.  Fleming paid $200,000 income tax to CountryA. If Fleming takes the foreign tax credit, compute its worldwide tax burden as a percentage of its pretax income.

Fleming paid $200,000 income tax to CountryA. If Fleming takes the foreign tax credit, compute its worldwide tax burden as a percentage of its pretax income.

Definitions:

Wasteful Spending

This refers to the unnecessary or excessive use of funds.

Corporate Valuation Model

Defines the total value of a company as the value of operations plus the value of nonoperating assets plus the value of growth options.

Pro Forma

Financial statements or projections based on hypothetical scenarios or certain assumptions to forecast future performance.

Free Cash Flows

The amount of cash generated by a company after accounting for capital expenditures, important for assessing its financial health and potential for growth.

Q22: The domestic production activities deduction is computed

Q27: Investment expenses are a miscellaneous itemized deduction

Q30: Many Mountains, Inc. is a U.S. multinational

Q38: Miss Blixen's regular income tax is $77,390,

Q49: Mr. and Mrs. Cox reported $115,900 AGI

Q50: Which type of audit takes place at

Q74: Mr. and Mrs. Toliver's AGI on their

Q84: The federal government collects more revenue from

Q96: Which of the following taxpayers can't use

Q98: The federal taxable estate of a decedent