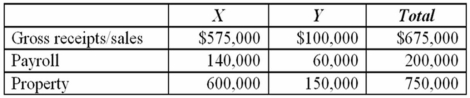

Origami does business in states X and Y. State X uses an equally-weighted three-factor apportionment formula and has a 4 percent state tax rate. State Y uses an apportionment formula that double-weights the sales factor and has a 6 percent tax rate. Cromwell's taxable income, before apportionment, is $3 million. Its sales, payroll, and property information are as follows.  a. Calculate Origami's apportionment factors, income apportioned to each state, and state tax liability.

a. Calculate Origami's apportionment factors, income apportioned to each state, and state tax liability.

b. State Y is considering changing its apportionment formula to a single sales factor. Given its current level of activity, would such a change increase or decrease Origami's state income tax burden? Provide calculations to support your conclusion.

Definitions:

Erikson's Theory

A psychoanalytic theory of human development that outlines eight stages from infancy to late adulthood, each characterized by a specific psychological conflict.

Final Crisis

A significant, potentially destabilizing event or period seen as the concluding phase of a situation or era.

Despair

a state of mind characterized by feelings of loss, hopelessness, or pessimism.

Coping

Strategies or mechanisms employed by individuals to handle, manage, or adapt to stress and difficult situations in life.

Q3: Carl had $2,000 gambling winnings and $8,400

Q20: On January 1, Leon purchased a 10%

Q42: Which of the following statements regarding a

Q44: Bernard and Leon formed a partnership on

Q55: A limited liability company with more than

Q61: Only accrual basis individuals are required to

Q67: Mr. and Mrs. Clyde were married for

Q85: If Gamma Inc. is incorporated in Ohio

Q86: Only one spouse must sign a jointly

Q110: Mrs. Paley died on July 14, 2012.