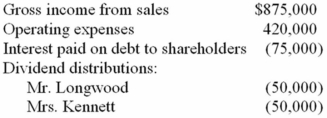

Mr. Longwood and Mrs. Kennett are the equal shareholders in LK Corporation. Both shareholders have a 39.6 percent marginal tax rate on ordinary income. LK's financial records show the following:  a. Compute the combined tax cost for LK, Mr. Longwood, and Mrs. Kennett attributable to LK's operations.

a. Compute the combined tax cost for LK, Mr. Longwood, and Mrs. Kennett attributable to LK's operations.

b. How would your computation change if the interest on the shareholder debt was $175,000 and LK paid no dividends?

Definitions:

Dramatic Nature

The quality of being strikingly emotional or theatrical in character or events.

Emotional Response

refers to the psychological reaction to an event or information, characterized by feelings such as happiness, anger, fear, or sadness.

Threats

Statements or actions that aim to cause harm or force someone to do something against their will.

Persistence

The continued effort to achieve an objective despite challenges or obstacles.

Q6: Mr. and Mrs. Blake suffered two casualty

Q14: Gift tax is based on the donor's

Q31: Which of the following federal taxes is

Q32: Lincoln Corporation, which has a 34% marginal

Q40: The potential for conflict among taxing jurisdictions

Q55: Any gain recognized on the sale of

Q61: Galaxy Corporation conducts business in the U.S.

Q67: Which of the following is not an

Q86: Mr. and Mrs. Casey have two dependent

Q111: Alice Grim, a single taxpayer, has $219,000