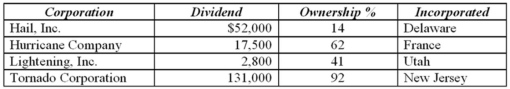

Thunder, Inc. has invested in the stock of several corporations and has $500,000 operating income before dividends.  Calculate Thunder's dividends-received deduction and taxable income:

Calculate Thunder's dividends-received deduction and taxable income:

Definitions:

Temporary Differences

The differences between the accounting income and taxable income that are not permanent and will reverse in future periods.

Permanent Differences

These are variations between taxable income and accounting income that originate from certain items being recognized in one manner for tax purposes and another for financial reporting purposes and do not reverse over time.

Pretax Financial Accounting

The process of preparing financial statements that calculate revenues, expenses, and earnings before taxes are deducted.

Taxable Income

The portion of income that is subject to income tax after adjustments, deductions, and exemptions are applied.

Q5: In 1996, Mr. Exton, a single taxpayer,

Q8: Which of the following statements regarding exemptions

Q9: Which of the following does not contribute

Q27: Which of the following statements about sales

Q32: In its first taxable year, Platform, Inc.

Q46: A partner's distributive share of partnership profits

Q53: Cramer Corporation and Mr. Chips formed a

Q62: Adam and Barbara formed a partnership to

Q63: The unextended due date for the individual

Q91: The tax consequences of a business activity