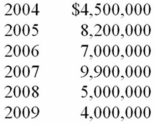

Grumond was incorporated on January 1, 2004, and adopted a calendar year for tax purposes. It had the following gross receipts for its first six taxable years:  For which of these years is Grumond exempt from AMT?

For which of these years is Grumond exempt from AMT?

Definitions:

Value Diversity

Appreciating and respecting the variety of differences in individuals, including culture, race, religion, gender, and sexual orientation.

Values, Attitudes, Behaviors

Core beliefs or principles that influence how individuals perceive the world and drive their actions and reactions.

Mistrusting Attitude

A disposition of doubtfulness or skepticism towards the intentions or integrity of others.

Observe Behavior

The act of carefully watching and analyzing actions and reactions in a systematic manner.

Q16: Jason, a single individual, is employed by

Q22: Which of the following statements concerning the

Q51: At the beginning of year 1, Paulina

Q59: Sunny, a California corporation, earned the following

Q61: Galaxy Corporation conducts business in the U.S.

Q73: Mr. and Mrs. Gupta want to make

Q78: For the current tax year, Cuddle Corporation's

Q87: Ms. Poppe, a single taxpayer, made three

Q92: Mia inherited $1 million from her deceased

Q106: Two years ago, James loaned $60,000 to