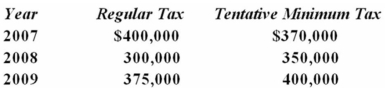

Tropical Corporation was formed in 2007. For 2007 through 2009, its regular and tentative minimum tax were as follows:  a. Compute Tropical's tax due for each year

a. Compute Tropical's tax due for each year

b. In 2010, Tropical's regular taxable income is $2,000,000, and it has positive AMT adjustments of $500,000 and AMT preferences of $600,000. Compute Tropical's regular tax, tentative minimum tax, and tax due for 2010.

Definitions:

Proper Name

A specific reference to a unique individual, place, or thing, typically starting with a capital letter and used to give identity.

Limited Partnership's Property

Assets owned by a limited partnership, which are used for the partnership's business and may be subject to claims by creditors, separate from the personal assets of the partners.

Gift

Something given voluntarily without payment in return, as to show favor toward someone or honor an occasion.

Ownership Interest

A legal or equitable right, claim, or stake in property, giving the holder some degree of control or participation in the property's benefits, like income, or decision-making.

Q5: New York, Inc. owns 100% of Brooklyn,

Q19: If a business is formed as an

Q23: Loretta is the sole shareholder of Country

Q32: Lincoln Corporation, which has a 34% marginal

Q38: The domestic production activities deduction is a

Q46: Only the government may appeal a tax

Q49: Which of the following statements about tax

Q55: Mr. and Mrs. Holt made no taxable

Q56: Gabriel operates his business as a sole

Q93: Lori owns a vacation home that she