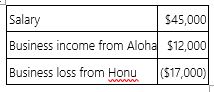

Ms. Mollani owns stock in two S corporations, Aloha and Honu. This year, she had the following income and loss items:

Compute Ms. Mollani's AGI under each of the following assumptions.

Compute Ms. Mollani's AGI under each of the following assumptions.

Definitions:

Ducks Unlimited

Ducks Unlimited is an American nonprofit organization dedicated to the conservation of wetlands and associated habitats for waterfowl, wildlife, and people.

Sackville Waterfowl Park

A natural sanctuary located in New Brunswick, Canada, that provides habitats for various species of ducks, geese, and other waterfowl.

Species

A gathering of organisms that are similar in nature, capable of sharing genetic material or interbreeding among themselves.

Community-based Effort

Initiatives undertaken by local communities to address and solve issues affecting them, often emphasizing grassroots participation.

Q2: Partners receiving guaranteed payments are not required

Q11: Which of the following taxes is a

Q16: Which of the following items might an

Q42: Less than half of the state governments

Q53: The four primary legal characteristics of a

Q56: Josh donated a painting to the local

Q57: Mr. Dilly has expenses relating to a

Q58: Mr. and Mrs. Steel, who file a

Q89: WEK Inc. is a New York corporation

Q103: Mrs. Connelly, a self-employed individual, maintains a