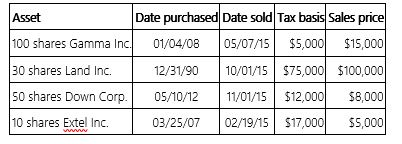

Frederick Tims, a single individual, sold the following investment assets this year.  If Frederick's marginal tax rate on ordinary income is 33%, compute his tax attributable to the above sales.

If Frederick's marginal tax rate on ordinary income is 33%, compute his tax attributable to the above sales.

Definitions:

Suicidal Tendencies

A pattern of thoughts or behaviors that indicates a risk for suicide, including ideation or attempts.

Musicians Liable

The responsibility or obligation of musicians, often in legal contexts, regarding their actions, performances, or music production.

Legally Intoxicated

A legal definition regarding the level of alcohol or drugs in one's system that impairs abilities to drive or operate machinery safely as defined by law.

Alcohol

Any beverage containing ethyl alcohol, including beer, wine, and liquor.

Q16: Wave Corporation owns 90% of the stock

Q21: Lindsey owns and actively manages an apartment

Q31: Bart owns 100% of an S corporation

Q33: Tony Curtis filed her 2014 income tax

Q36: The interest earned on investments in U.S.

Q36: The Internal Revenue Code is written by

Q55: Any gain recognized on the sale of

Q58: Article 1 of the U.S. Constitution, referred

Q75: Three years ago, Suzanne bought a new

Q106: Two years ago, James loaned $60,000 to