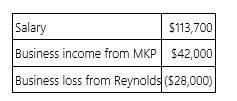

Ms. Watts owns stock in two S corporations, MKP Corporation and Reynolds Inc. This year, Ms. Watts had the following income and loss items.  If Ms. Watts materially participates in the business of both corporations, compute her AGI.

If Ms. Watts materially participates in the business of both corporations, compute her AGI.

Definitions:

Regular Exercise

A routine of physical activity performed consistently for the purpose of maintaining or improving one's health and fitness.

Reduced Cancer Risk

The lowering of the probability of developing cancer, achieved through lifestyle changes, such as diet, exercise, and avoidance of carcinogens.

Cardiovascular Fitness

The ability of the heart, blood cells, and lungs to supply oxygen-rich blood to the working muscle tissues and the ability of these muscles to use oxygen to produce energy for movement.

Immune Response

The body's defense mechanism against pathogens, involving the activation of immune cells and the production of antibodies.

Q6: Which of the following statements concerning property

Q9: Joanna has a 35% marginal tax rate

Q18: Ms. Plant owns and actively manages an

Q26: Galaxy Corporation conducts business in the U.S.

Q28: Employees who deliberately have excess income tax

Q38: A bilateral agreement between the governments of

Q56: Wages paid by an employer to an

Q61: Which of the following taxes is a

Q81: Which of the following statements comparing traditional

Q91: An employee receives $110,000 of group term