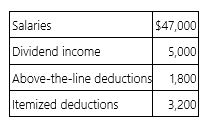

Mr. and Mrs. Liddy, ages 39 and 41, file a joint return and have no dependents for the year. Here is their relevant information.  Compute their adjusted gross income (AGI) and taxable income.

Compute their adjusted gross income (AGI) and taxable income.

Definitions:

Degrees of Freedom (df)

Number of values or quantities free to vary when a statistic is used to estimate a parameter.

Expected Frequency

In statistics, the frequency expected in a category of a contingency table under the assumption that the null hypothesis is true.

Chi-Square

A statistical test that measures the difference between observed and expected frequencies in categorical data.

Row Variable

In the context of a data table or matrix, it refers to the variable represented by the rows, often used in cross-tabulation to compare against another variable.

Q8: Mr. Dilly has expenses relating to a

Q26: An S corporation generated $160,000 ordinary taxable

Q28: Cambridge, Inc. conducts business in states X

Q31: Mr. and Mrs. Kay, ages 68 and

Q39: Adjusted gross income equals total income less

Q52: The United States taxes its citizens on

Q52: Up to $100,000 of loss recognized on

Q53: Mr. and Mrs. Reid reported $435,700 ordinary

Q56: In 2015, Mr. Ames, an unmarried individual,

Q95: Only natural and adopted children or stepchildren