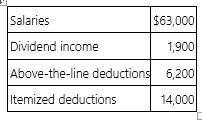

Mr. and Mrs. Dell, ages 29 and 26, file a joint return and have no dependents for the year. Here is their relevant information.  Compute their adjusted gross income (AGI) and taxable income.

Compute their adjusted gross income (AGI) and taxable income.

Definitions:

Physiological

Relating to the functions and processes of the body's systems and organs, often in the context of understanding biological mechanisms underlying behaviors and mental states.

Cognitive Changes

Alterations in cognitive functions such as memory, attention, perception, and problem-solving, which may occur due to aging, neurological diseases, or psychological conditions.

Genetic Predispositions

The inherited genetic patterns that influence the likelihood of developing certain diseases or conditions.

Fluid Intelligence

The ability to think abstractly, reason, identify patterns, and solve problems with new information, independent of acquired knowledge.

Q1: Mr. Jones and his first wife were

Q3: Congress provides an indirect subsidy to charities

Q5: If a corporation has a high debt-to-equity

Q15: The use of a corporation as a

Q21: Revenue rulings and revenue procedures are written

Q46: Only the government may appeal a tax

Q52: Mr. Marshall was employed by IMP Inc.

Q77: Lana, an employee of Compton University, paid

Q80: Qualified withdrawals from both traditional and Roth

Q81: This year, Plateau, Inc.'s before-tax income was